2025 3rd Quarter Letter

A Look at Federal Reserve Rate Projections

Dear Clients,

As we have wrapped up the third quarter of 2025, our team wanted to send an update on market and economic conditions.

Market Recap: Q3 2025

U.S. large cap stocks grew a solid 8.12%, led primarily by the tech and healthcare sectors. Investor enthusiasm has remained high around artificial intelligence and cloud infrastructure, and the largest companies are investing substantial dollars into AI progress.

International stocks collectively grew 6.97%. Easing trade tensions, local stimulus, and investor attraction to lower valuations boosted returns.

The Aggregate bond market grew 2%, which mostly consisted of returns from interest. Longer term treasury yields dropped slightly as the Federal Reserve decided to reduce short-term rates for the first time this year.

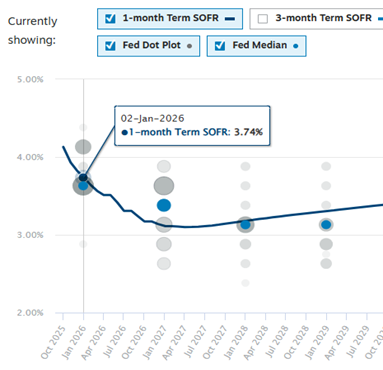

The above chart shows the SOFR (Secured Overnight Financing Rate) currently at 4.13%. The dots represent each Fed governors’ projections, with the larger dots showing more consensus. It’s important to understand that these are projections, and they will change based on data that’s released in the future. Currently, the median projection shows a downward trend of about 100 basis points by 2027. If this happens, lower borrowing costs could boost corporate and real estate profitability.

At Miller Wealth Management, we are watching developments in interest rate changes, global wars, tariffs, and a quickly changing AI and digital landscape. While change is certain, we believe it is important to stand on beliefs and convictions that never change. We look forward to continuing that journey with our clients!

Sincerely,

Stephen W. Miller, CIMA, CRPC® James E. Miller, CFP®, CKA®

Senior Wealth Advisor Senior Wealth Advisor

J. Parker Morris, CFP® Tucker Bryan, AAMS®

Wealth Advisor Associate Financial Planner

Chart: Chatham Financial - https://www.chathamfinancial.com/technology/us-forward-curves

Stated return sources from Morningstar:

· Large Cap Stocks: Vanguard S&P 500 – symbol VOO

· International Stocks: Vanguard Global Ex-U.S. - symbol VXUS

· Aggregate bond market: Vanguard Total Bond Market – symbol BND

Miller Wealth Management is a team of EverSource Wealth Advisors, LLC, an SEC registered investment advisor.

This letter is for informational purposes only, is general in nature and does not take your personal circumstances into consideration. It does not constitute an invitation, solicitation or offer that you purchase, sell, or hold any security or other investment or pursue any investment style or strategy. It is not intended to be a substitute for specific, individualized financial advice and investors should obtain tax and/or legal advice from a qualified tax professional and/or attorney. Past performance does not guarantee future results. The information, including any analysis or investment strategies, is expressed as of the date hereof and is subject to change. EverSource Wealth Advisors LLC assumes no obligation to update or otherwise revise these materials. Please see the EverSource customer relationship summary disclosure (Form CRS) for additional information.