2025 2nd Quarter Letter

Stock Market Recovery During Geopolitical Uncertainty

Dear Clients,

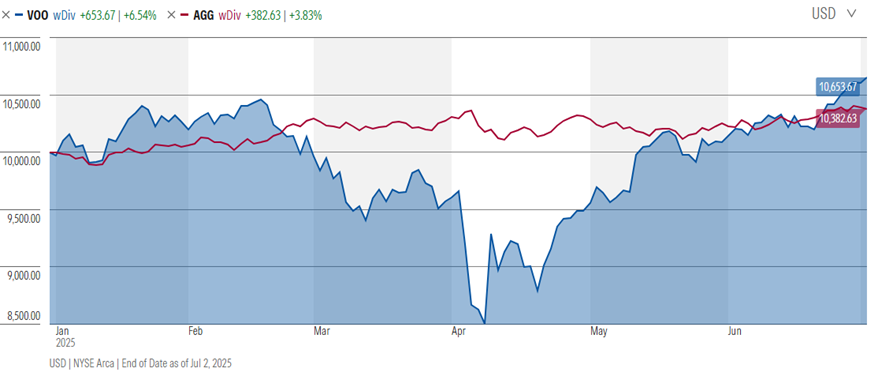

The 2nd quarter began with a dramatic market selloff due to global tariff wars. U.S. stocks had dropped by ~20% after the first week in April (see chart below from February to April). However, we experienced a historically quick rebound, and stocks ended the quarter with solid gains, hitting an all-time high on June 30th. The recovery was driven by both easing trade tensions and strong corporate earnings. The chart below shows year-to-date performance of the S&P 500 index (shown in blue) and the U.S. Aggregate bond index (shown in red).

What’s behind these market returns?

A common question is how the markets are performing well despite global geopolitical concerns, trade tensions, wars, high interest rates, and an ever-growing Federal debt issue. While these are all ongoing issues to face, it’s important to recognize a unique period we are in:

Tech and AI boom – most companies have adopted AI in some form. The largest U.S. companies are investing billions into AI and are already benefitting from automation, productivity, and personal assistance services.

Energy boom – due to technological innovation, high energy prices, and global demand growth, more energy sources are needed. From this flows job creation, infrastructure development, and economic growth.

Medicine advances – major investments are going into the medical industry, and innovative drugs are resulting in more effective treatment, greater personalization, and earlier disease detection.

Consumer spending – the appetite for travel, home improvement, and other consumer spending categories remains strong.

NATO spending – while the U.S. has pulled back from arms support in Ukraine, European countries have picked up the ticket — and defense companies are benefitting from it.

Tight labor market – when labor is hard to find and supply doesn’t meet demand, prices typically rise —and higher prices lead to greater profits.

What to watch for in the 3rd Quarter

How will the Federal Reserve balance inflation concerns with economic slowdown risks? Projections are showing 2-3 rate cuts for the rest of this year.

The 90-day pause in higher tariffs expires on July 9th. Will deals be struck, and which countries will come to the table?

The Federal Government has passed the ‘Big, Beautiful Bill.” We are actively reviewing impacts to clients’ financial planning.

While we study and watch these events play out, we always lean on investment principles that stand the test of time and help in any market environment. Thank you for your trust in the Miller Wealth Management group.

Sincerely,

Stephen W. Miller, CIMA, CRPC® James E. Miller, CFP®

Senior Wealth Advisor Senior Wealth Advisor

J. Parker Morris, CFP® Tucker Bryan, AAMS®

Wealth Advisor Associate Financial Planner

Miller Wealth Management is a team of EverSource Wealth Advisors, LLC, a registered investment advisor (RIA).

This letter is intended for clients of Miller Wealth Management and should not be forwarded or shared with others.

This letter is for informational purposes only, is general in nature and does not take your personal circumstances into consideration. It does not constitute an invitation, solicitation or offer that you purchase, sell, or hold any security or other investment or pursue any investment style or strategy. It is not intended to be a substitute for specific, individualized financial advice and investors should obtain tax and/or legal advice from a qualified tax professional and/or attorney. The information, including any analysis or investment strategies, is expressed as of the date hereof and is subject to change. EverSource Wealth Advisors LLC assumes no obligation to update or otherwise revise these materials. Please see the EverSource customer relationship summary disclosure (Form CRS) for additional information.